If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Tesla reported the biggest loss in its history. But it could’ve been worse

- Two recession warning signs are here

- Papa John’s hires ad agency to rebrand after N-word controversy

- Wells Fargo to pay $2.09 billion fine in mortgage settlement

- Federal Reserve keeps interest rates unchanged

- Three people arrested for massive Chipotle, Arby’s, Chili’s hacks

- The strange world of YouTube creator side gigs

- Champion is ending a popular line at Target

- Express Scripts stock plunges on report that Carl Icahn wants to block Cigna merger

- Caesar’s stock plunges on worries about Vegas hotel bookings

- Why Campbell Soup might go up for sale

- Who is Cody Wilson, the man behind the 3D printed gun?

- Facebook now tells you how much time you spend on it

- How to get a non-tech job in tech

- The biggest threat to Volkswagen: New emission tests

- Kroger launches online grocery delivery service

- Your MoviePass questions, answered

- Sanofi and Novartis are stockpiling drugs to prepare for Brexit

- The $4.5 trillion experiment rattling markets

- Trump could raise tariffs on $200 billion in Chinese goods

- 3 tricks billionaires use to make their money work for them

- Why gold is plunging despite market volatility

- India just raised interest rates again. There may be more

- Facebook takes down suspected Russian network of pages

- Worsening hostility toward the press

- Place your bets: The NBA just struck a deal with a casino

- MoviePass is hiking its price and cutting access to blockbusters

- Pampers and Charmin are getting more expensive

- Americans are rushing to invest in Switzerland

- US escalates trade spat with one of the world’s poorest countries

- Russia dumped 84% of its American debt. Here’s what that means

- Customers got sick at a Chipotle in Ohio, sending its stock down 6%

- Mercedes is trying to get cheap luxury cars right

- Tesla’s magic is wearing off

- This self-driving van uses screens to talk to pedestrians

- Amazon can’t touch these discount stores

- Why men get the ‘glamour work’ assignments more than women

- Amazon HQ2 bid is already paying off for some cities

- Half of the group behind Kendrick Lamar and Lady Gaga is for sale. Who will bite?

- Interest rates are going up. Here’s what to do

- Sony is cashing in on its big stake in Spotify

- The tech bloodbath is here

Select Bullets from Fox Business…

- Everything you need to know about the capital gains tax cut[overlay]

- Everything you need to know about the capital gains tax cut

- Fed keeps interest rates unchanged, says US economy ‘strong’

- Apple shares rally after iPhone sales boost earnings

- Texas sand dunes go from worthless desert to mega-valuable commodity

- Buffett loans whopping $2B to Sears property owner

- Wells Fargo hit with $2 billion fine over faulty mortgages

- Fidelity to launch no-fee index funds

- Top 5 states with highest, lowest student loan debt

- Car shoppers finding fewer 0% finance deals

- Trump OKs sale of revamped short-term health care plans

- This state offers six-figure salaries without a college degree

- Trump to slap 25% tariff on $200 billion Chinese goods

- US workers get biggest pay increase in a decade

- Elon Musk blasts Tesla short seller David Einhorn

- Why Iran, China have more to lose than the US, Trump

- Reddit suffers data breach

- China’s Huawei surpasses Apple in smartphone sales

- The Chinese tech company is now the second-largest smartphone maker in the world.

- How 3D technology is improving cancer detection

- These automakers are releasing flying cars in the near future

- New York state shuts down child’s lemonade stand

- Katz’s Deli, secrets behind keeping a 130-year-old business alive

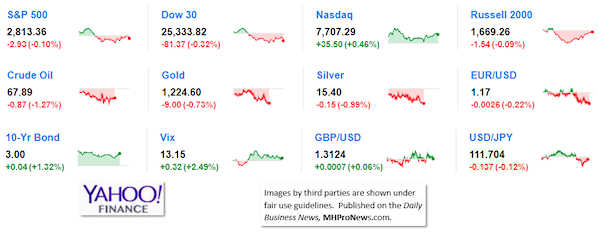

Today’s markets and stocks, at the closing bell…

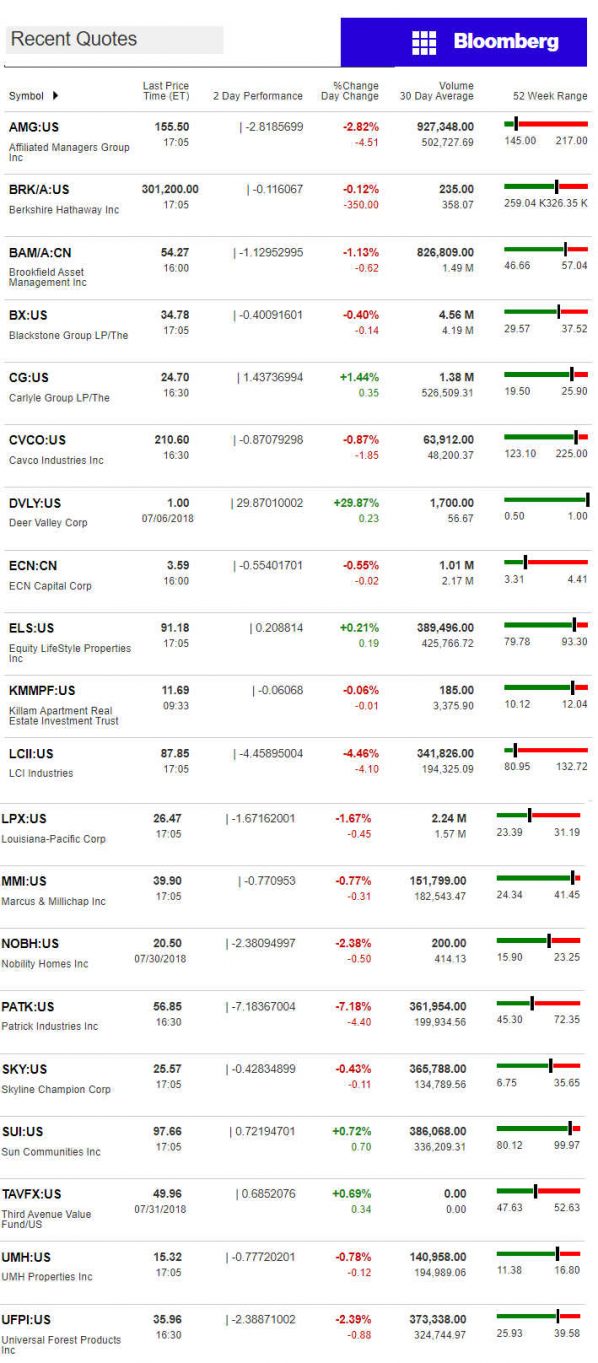

Today’s Big Movers

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

The fines levied against Wells Fargo today were for allegations the firm was misrepresenting loan quality prior to the 2008 financial crisis. So, they’ve been a long time coming.

In a release to the Daily Business News, the U.S. attorney’s office in California announced Wednesday that it’s fining Wells Fargo $2.09 billion for allegedly mispresenting loan quality for mortgages it originated sold that were part of the run-up to the 2008 financial crisis.

Daily Business News readers may recall that the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency fined the bank $1 billion over claims of improper mortgage and auto-lending practices.

“This settlement holds Wells Fargo accountable for actions that contributed to the financial crisis,” said Acting Associate Attorney General Jesse Panuccio. “It sends a strong message that the Department is committed to protecting the nation’s economy and financial markets against fraud.”

“Abuses in the mortgage-backed securities industry led to a financial crisis that devastated millions of Americans,” said Acting U.S. Attorney for the Northern District of California, Alex G. Tse. “Today’s agreement holds Wells Fargo responsible for originating and selling tens of thousands of loans that were packaged into securities and subsequently defaulted. Our office is steadfast in pursuing those who engage in wrongful conduct that hurts the public.”

“Abuses in the mortgage-backed securities industry led to a financial crisis that devastated millions of Americans,” Alex Tse, acting U.S. attorney for the Northern District of California, said in a statement. “Today’s agreement holds Wells Fargo responsible for originating and selling tens of thousands of loans that were packaged into securities and subsequently defaulted.”

For a giant lender like Wells Fargo, has the punishment fit the crime? And in the end, isn’t it consumers that pay for this fine, because the bank will just pass along the costs to their customers, over time?

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.