Among the hottest topics in manufactured housing are routinely those related to financing. We see that keen interest in financing at live industry events, such as seminars that take place at the Louisville Show, or the rapidly organized and high interest being shown in Texas Manufactured Housing Association's Dodd-Frank summit, both taking place in January 2014. We see that high level of interest in articles about financing being read here on MHProNews too. For example, the single hottest read so far in December is this Industry in Focus report on HR 1779, which we've just updated with a new download of the letter from Consumer Financial Protection Bureau (CFPB) Director, Richard Cordray, which will be the subject of this analysis.

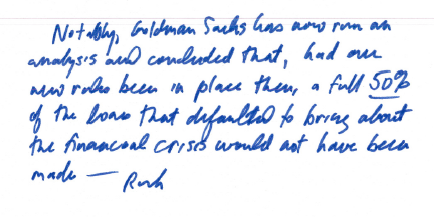

CFPB Director Cordray finished the polite letter, in which he declined delays requested by a bi-partisan call on behalf of manufactured home owners and industry members expressed by 11 U.S. Senators. At the end of the letter, Cordray added a pair of hand written notes.

Here is a screen capture of those second of those two hand-written notes.

.png)

In reply to Director Cordray's note, we are not going to review the Goldman Sachs analysis, but we will make a point that both national associations in manufactured housing have made in their own unique ways. Namely, that the manufactured housing industry had less than zero to do with the financial crisis that brought about the stringent rules that the CFPB is implementing.

To de-facto punish manufactured housing home owners and business (as if our industry were part of the mortgage-bubble-bust), as CFPB rules will do is just flat wrong! It is a little akin to arresting someone who witnessed a crime and treating that witness the same as the one accused of the alleged offense.

A further look at Director Cordray's decision is even more troubling in its reasoning.

First, those U.S. Senators Constitutionally represent “We, the People.” It isn't just the industry's interest he is saying no to, it is the interests of those millions of home owners represented by those U.S. Senators at the well over 100 Congressman who have signed onto HR 1779.

Second, while MHProNews respects the organizations referenced in Cordray's letter as “consumer groups,” that begs the question, who in fact are those “consumer groups” and where do they get their funding? Is it from consumers? No. It is often from foundations. While those groups may in fact desire to advocate for consumers, which is noble, one might ask, do those groups have as close a connection to manufactured home consumers as our industry does?

That could be a long analysis in itself, but let's be clear. A business – or industry – has to serve its consumers or they tend to go out of business. No one has a greater stake in consumer protection than the manufactured home industry professionals do!

Third, while one lender said tongue in cheek to this scribe that manufactured housing lending in the later part of the 1990s was the “Petri dish” for the kinds of abuses the mortgage industry fell into, that same lender added, “But we cleaned up our act ourselves, without Congressional or regulatory intervention. The market worked on its own. We have our own vested interest in making sure that loans perform and consumers succeed.”

Another lender echoed a similar sentiment, saying that sustainability in lending combined with consumer safeguards are an obvious win-win.

No major lender in our industry wants to make bad loans! Major publications covered stories during the 2008 post-mortgage-meltdown, that referenced Warren Buffett's Berkshire-Hathway manufactured home lenders having loan performance better than conventional lending was experiencing.

That same point isn't limited to Berkshire-Hathaway linked MH lenders, it could have been made about any of the major MH industry regional or national lenders.

Buffett was quoted by the Wall Street Journal as saying,

“Last year I told you why our buyers – generally people with low incomes – performed so well as credit risks. Their attitude was all-important: They signed up to live in the home, not resell or refinance it. Consequently, our buyers usually took out loans with payments geared to their verified incomes (we weren’t making ‘liar’s loans’) and looked forward to the day they could burn their mortgage. If they lost their jobs, had health problems or got divorced, we could of course expect defaults. But they seldom walked away simply because house values had fallen. Even today, though job-loss troubles have grown, Clayton’s delinquencies and defaults remain reasonable and will not cause us significant problems.” (Editor's note, emphasis added).

Cordray's letter says in part, “It is critical that we move forward so these rules can provide new protections for consumers and provide certainty that the industry has been seeking.”

I'm sorry, but Richard Cordray has missed the mark widely! The uncertainty in the markets – including but not limited to manufactured housing – has arguably been caused more by federal issues, rather than by the market itself.

However noble Cordray's intentions may be, I've heard from more than one source that “They (the CFPB) heard us, but they don't believe us.” If so, who then does Cordray believe?

Of course the industry is pleased with the accommodations that were granted on appraisals and other issues. But those accommodations by the CFPB to date are only a start. They are not nearly enough to protect thousands of jobs, many businesses and our millions of home owners. Our loans are for lower balances, they tend to require more servicing and yet the cost to originate a 30,000 manufactured home loan is similar to a $250,000 conventional housing loan. The law must take these and other factors into account.

The utter logic of our industry's request and the performance of our loans in the last decade-or-so has been lost on the Director and/or his staff at the CFPB. Or are they being ignored for other – perhaps political? – reasons? We can't say.

What we can say is that the CFPB is making mistakes very much akin to those plaguing the ObamaCare roll out, only in this case, the impact will be on financing that is the life blood of so much of our economy. HHS ignored the warning signs, everyone dug in their heels on the regulatory end and in the Obama Administration.

The Solons of DC have all too often taken a Utopian view rather than a practical one. Real people and real businesses suffer as a result.

A number of bankers and lenders that tell me that the policies put in place are harmful. Others in the media are reporting on the negative impact of these regulations too, it is just that not enough of the media are focused on the impact on manufactured housing and the 20-23 million Americans who live in our industry's homes!

The "GreenSeco" days of the MHIndustry are dead and gone. There is no rush by any major lender I know of to return to them. Those I know in the industry who were with Conseco, or other lenders with similar practices, learned the lessons well. Not one woman or man I know who experienced the consequences of the MH lending meltdown has suggested that we return to the dark days of a wink-and-a-nod to get another deal done, even if all suspected the loan would blow up. We as an industry paid that price in starting in 1999 and on into the 2000s.

Do the Feds think we in manufactured housing or our home owners need to pay the price on that forever?

Let's hasten to add that not enough attention is paid to the politics that caused the mortgage meltdown. Equity Lifestyle Properties (ELS) Chairman, Sam Zell referred to that, as we've reported previously. Political decisions were made that helped fuel the conventional mortgage crisis. Manufactured housing had essentially nothing to do with that either.

Director Codray, please don't let the DC bubble or politics keep you from seeing and acting upon the truth that our industry's lenders and various associations leaders' have been sharing. Without the changes requested, lending will constrict to the kinds of home owners that Warren Buffett's quote above references.

Who will that harm the most? Frankly, first our millions of our home owners. Yes, it will impact businesses too, but our home owners who may from time to time need to refinance or sell will be harmed the most.

To paraphrase Edmund Burke, those who don't know or learn from the past are condemned to relieve it's pains.

Let's not let unintended consequences that are easily foreseen by seasoned professionals – who are motivated to do right by all involved – stop regulators, politicians or others of good will from doing what is necessary to correct what's wrong with Dodd-Frank and the SAFE Act.

Please see the article and the download linked in our report on HR 1779, as well as this Daily Business News article, both of which now include a download of Richard Cordray's polite but “No” letter to 11 U.S. Senators.

As always, my opinions are mine and should not be construed to represent the views of this or that person or organization. We welcome and publish differing views.

Let's close with a simple thought. It would be wonderful if the CFPB responded to the industry's lobbying efforts. It was – and is – a worthy effort. But we can't have all our eggs in that one basket. We expect a companion bill to HR 1779 to drop in the Senate, perhaps as soon as Monday, see that article here.

MH Industry pros, it is past time to make our next big push! Our industry could be the answer to America's affordable housing crisis, if only the regulators and public officials will do what's right. We could create tens of thousands of new jobs, and protect millions of manufactured home owners values and access to credit. Together, we can make the changes needed to protect our home owners and our businesses too. Together, yes we can. ##

PS: Check our many Exclusive and Red Hot Featured Articles for December and see the other new stories at MHLivingNews.com too

.jpg) L. A. 'Tony' Kovach

L. A. 'Tony' Kovach

ManufacturedHomeLivingNews.com|MHProNews.com|

Business and Public Marketing & Ads:B2B|B2C

Websites, Contract Marketing & Sales Training, Consulting, Speaking:

MHC-MD.com|LATonyKovach.com| Office863-213-4090

Connect on LinkedIN:

http://www.linkedin.com/in/latonykovach