The Manufactured Housing (MH) industry has never been monolithic. There has been and always will be various voices and groups within the industry landscape. Part of our challenge in getting a bill such as HR 650/Preserving Access to Manufactured Housing passed – great job to all who made it happen! – is that we do have a wide array of interests that fall under the MH Pro umbrella.

If we looked back into the past, the reason that the Manufactured Housing Association for Regulatory Reform (MHARR) exists is because the smaller, independent producers of HUD Code manufactured homes felt the bigger MH builders were pushing for (or not opposing) regulations and policies that were contrary to their interests.

What would happen if larger builders and mid-to-smaller ones became comfortable enough with each other so that they were all under the same joint association flag? Do you see 2 different national associations for real estate agents?

Left to right: Ernesto, Jim Clayton, Scott Roberts, Shaun (sp?) and Kevin Kimzey.

some of the Who’s Who In manufactured housing at the 2015 Congress and Expo.

Please don’t misread that as a call for unity, that would be premature. It is just to make the point that follows.

Namely, that because we are not unified, because we have so many divergent groups and views, it creates issues for an industry of our size given the various challenges we face. This is why serious industry growth has to be a top priority, more on that point at this link and in the near term too.

As an FYI, MHARR didn’t oppose HR 650. I’m told that any time their office was contacted about the issue, they gave verbal support for the bill’s passage. It is just that MHARR is more focused on GSE reform, a worthy cause and another topic for another day. Now, back to the HR 650 topic..

By contrast, those who advocate on behalf of the presumed interests of consumers are very united. They managed to get a chorus of articles published before and after the passage of HR 650. While they’ve been framed as an attack on specific industry lenders and companies, that is almost like bait – wedge politics – or divide and conquer strategies that sometimes are cooked up to achieve a given group’s goal.

I’ve already been told, there are two lines in the sand the anti-HR 650 forces have marshaled.

Some of the management and leadership from San Antonio Credit Union,

present at the 2015 Congress and Expo, in a private meeting.

Left to right, John Walters, CU Factory Built Lending, Anthony Ducharme, Mountainside Financial

and Barry Noffsinger, CU Factory Built Lending.

-

First, I’m told by ‘pro-consumer’ voices that they expect our fix for Dodd-Frank to be stopped in the Senate. Hmm…

-

Next, we are reminded that POTUS (the President of the United States) Barack Obama has already signaled that he will veto HR 650 if it hits his desk.

Now imagine that 2nd point! Here we have a nation that can’t get our policies straight with who are and are not state sponsors of terror overseas. POTUS wants to normalize relations with Iran and Cuba, has threatened to punish Israel and won’t support the Ukraine with weapons while they are being invaded by Russia. We have all kinds of domestic and international issues as a nation…

…and the president is taking the time to tell us he’ll veto a fix for Dodd-Frank? What’s up with that?

View from the MHProNews suite,

overlooking Paris Hotel Complex in Las Vegas.

Story Telling Time…

We have to get better at telling our own stories and those of our home owners. Period. Some of these are complex issues. I see industry pros whose eyes glaze over when you start talking about why personal property (home only/chattel lending) rates are what they are. It isn’t predatory lending, its called pricing for the risk and costs, which by the way, regulations have increased both risks and costs!

So if it isn’t easy for a number of professionals, how can it be made easy to understand for the public at large?

That’s not an excuse not to try! It is a call to action to do what it takes to make the case.

Then perhaps well intentioned but ill informed voices – the opposition groups to HR 650 that wag their fingers at industry lenders – who have rates higher than site built housing rate. Do they not have a clue, apparently, as to what the GAO’s report that came out last year said about MH lending? Or they’ve ignored the facts that have come out. Either its sloppy research or its agenda driven, take you pick.

The article below and those links within that article give an array of facts that will get you or anyone armed to understand and explain the finance issues surrounding MH and personal property lending.

The link above has been privately praised by industry leaders as a good, generic response to some of the attacks on HR 650. We’ve had small to large players say, thank you, great job, excellent, etc. on the above. Please keep this page book marked, and share it often with media and those in public office, it is there to support your efforts.

Because collectively – you, us, others – we are the ones who are fighting for consumers rights! For the rights of millions of MH owners across America! They deserve access to financing that will protect the value of their asset, that manufactured home they enjoy and benefit from.

Post HR 650

I’ve received this among the flurry of messages for and against HR 650, and the post HR 650 comments. It is from Tim Williams, Executive Director, Ohio Manufactured Homes Association (OMHA). It read in part as follows:

Thank you to our faithful OMHA members for submitting letters, emails, and making phone calls to your U.S. House Representatives asking for their support for our industry critical legislation H.R. 650– Preserving Access to Manufactured Housing Act.

But, we’re not done yet! We eventually will need support from our Ohio Senators (Brown and Portman) to pass the companion bill S. 682 –Preserving Access to Manufactured Housing Act.

We could repeat that message from others across he country who have or soon will make that same kind of call to action.

Those perhaps well intentioned, but nevertheless misguided voices opposing HR 650 are ready to fight to the finish to keep Dodd-Frank from being changed. Are you ready to pick up the phone or email to ask your Senator or the Senator’s staffers for support on this bill? That call just takes a few moments.

Here is our post HR650 Daily Business News article. It shows who voted for what, Congressman Fincher’s statement and more. Kudos to all who made the efforts to make this happen! Our thanks for all who voted for this critically important pro-consumer and MH homeowner bill.

CFPB on Site at the MHI Congress and Expo event, Again…

I had a brief but pleasant chat with Marie Whittaker, a Market Analyst from the Office of Mortgage Markets for the Consumer Financial Protection Bureau (CFPB). This is the second year I’ve known of someone from the CFPB coming to this MHI event. Our tax dollars are clearly hard at work, as Marie is here to learn more about the MH industry.

I’m hoping Marie and the CFPB will look carefully at the article linked above and the various articles linked from it. Let me share the link with Marie and the CFPB anew, here, for their convenience.

An anti HR 650 source told me that facts matter. Indeed! I reminded that source that millions have been cut off from the financing they may need soon, should they sell their home. No reply to my counterpoint…because it is hard to answer the truth that you oppose when faced by its realities.

Need for changes?

Are there changes need in MH finance? You bet. We aren’t blindly supporting HR 650. There are voices in our industry’s ranks that see that issue differently too. But the point is this is a useful and important step, perhaps more for home owners with values under 20k to 25k than for the industry itself.

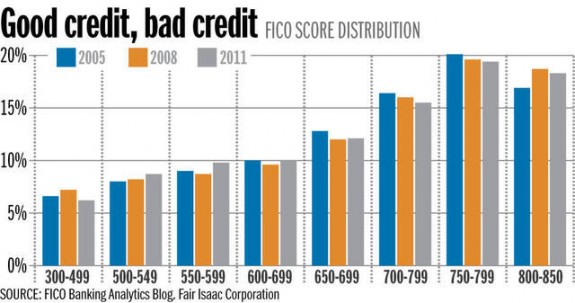

Credit scores have generally improved since this graphic from the Deseret News

was first published. While it is noble to serve the working class, and we should not

abandon serving that important market, we must get better at reaching out the

broader housing market. That is where opportunities aplenty exist.

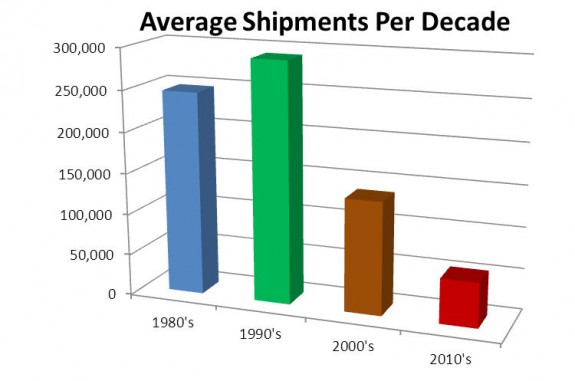

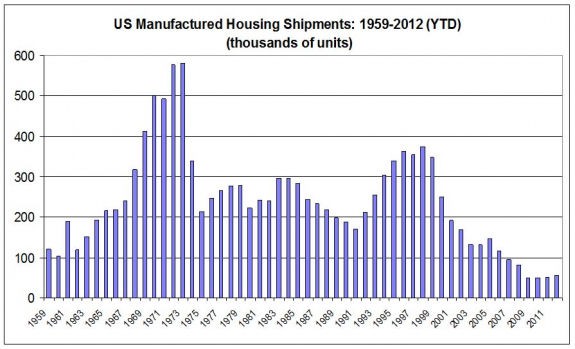

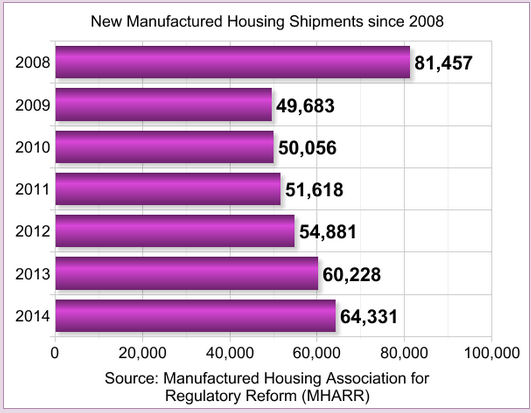

Why are we stuck in the 60,000+ range of MHShipments,

when we are in a trillion dollar a year housing industry

with about 1 million new housing MF and SF starts in 2014?

New MH Lender?

We’ve been talking and hinting for some months that there is a new lender coming into the space. Actually, there is more than one, nibbling at or check out MH financing. One of these has made the scene at Congress and Expo. Let me call it HAS Capital, Version 2.0. They are led by Scott Macfarlane, formerly the VP that led the MH program with U.S. Bank.

Scott Macfarlane has joined the HAS Capital team in a leadership role.

More on this developing story in MH home only lending in the days ahead.

Scott is taking on a leadership role in HAS operation. Official title, President of Originations. They are going to be bringing a new game to town. More on that in the days ahead, but keep your eye on developments from this one.

In a trillion dollar housing annual U.S. Housing Market, MH has and can do much better than it is.

We can sustainably and responsibly rebuild to a 500,000 new MH produced a year industry.

Ladies and gents, it is time to wrap this for now. Our great industry is at a cross roads, and many in our ranks don’t see it. There are opportunities aplenty for those doing the business well and properly. There are opportunities for those who go after serving not only the entry level market, but those who have cash or good credit. We are uniquely positioned to ‘do all of the above.’ Let’s borrow the Nike slogan. Just do it. ##